Moses Rose's owner Vince Cantu argues that the Alamo Trust and RSI & Associates, the appraisal firm it contracted to conduct a valuations of his tavern, failed to include projected lost revenue in their valuation. He maintains they did so without informing him or his attorney — even though all parties initially agreed to include it as part of the valuation.

Cantu also is accusing the Alamo Trust of coercing RSI to skew data on Moses Rose's projected lost profit from a possible relocation so it would result in a lower sale offer for his business.

Paperwork and email correspondence Cantu supplied to the Current appear to back up his claim that the Alamo Trust promised to include projected lost revenue in the valuation totals.

The valuation of the bar has been a significant sticking point for Cantu, the Alamo Trust and the city. The city and the Alamo Trust want to take over the bar's downtown property to make way for the $400 million Alamo Visitor Center and Museum and have made multiple buyout offers.

In April, the Alamo Trust offered Cantu its "best and final offer" of $5.26 million for both the real estate and business operations of Moses Rose's. However, Cantu refused, arguing that he won't accept anything below $9.02 million.

The clock is now ticking down for both sides to reach a deal or the city will start the condemnation process for the bar, located at 516 E Houston St. An April 21 press release from the Alamo Trust states that Cantu had until Monday, May 8 to accept an offer or face condemnation and an eminent domain takeover.

"[Alamo Trust Executive Director] Kate Rogers repeatedly asked me to come to the table, and to open my books, saying they would be happy to pay me more if I did, but after I did, it appears that the Alamo Trust directed RSI & Associates to change the rules, and lower the amount of their valuation," Cantu told the Current.

In a statement, Rogers fired back, calling Cantu's accusations "disappointing."

"Mr. Cantu's claims of a 'bait and switch' are categorically false," Rogers said. "Mr. Cantu has been offered $5.3 million — $4 million, or twice the appraised value for the property, and an additional $1.3 million for the business. The valuation of his business was conducted by an appraisal firm he selected and based on an approach that was approved by all parties."

Projected lost revenue

In emails from March between Alamo Trust attorney Daniela Serna and Cantu's attorney, L. Dan Eldredge Jr., the nonprofit organization assured Eldredge that projected lost revenue would be included in the valuation of Moses Rose's.

Most of the time, the term "projected lost revenue" refers to the amount of money a business would have accumulated from its operations over the next several years.

A Feb. 20 letter from the City of San Antonio also states that projected lost revenue would be included in a valuation for the business if Cantu opened his financial records for review, which he ultimately decided to do.

However, in records obtained by the Current, it appears that figure wasn't included included in RSI' s final report valuing Cantu's business.

"In the discussions with the Alamo Trust, they pulled that off the table and said, 'Just do fair market valuation,'" explained Gerald Brown, a senior analyst at RSI.

Brown said it's uncommon to have projected lost revenue included in eminent domain-related valuations, but he added that doing so for Moses Rose's would have likely valued the business somewhere between $15 million and $20 million.

Cantu said the Alamo Trust never told him or Eldredge, his attorney, that it no longer planned to include projected lost revenue in the report.

The Alamo Trust didn't provide comment or documentation refuting Cantu's claim that he was never notified of the change.

Discounted future earnings

Although RSI didn't include projected lost revenue in its report, it did include Moses Rose's discounted future earnings. RSI's Brown said projected lost revenue is standard inclusion in his company's appraisals.

However, Cantu said that figure is skewed. He maintains that an anonymous source within RSI told him and his attorney that the Alamo Trust threatened to not pay the appraisal firm unless it recalculated the discounted future earnings sum to result in a lower value.

Cantu said that he wants $9 million total — the $5 million in forecasted future earnings by RSI plus $4 million for the real estate.

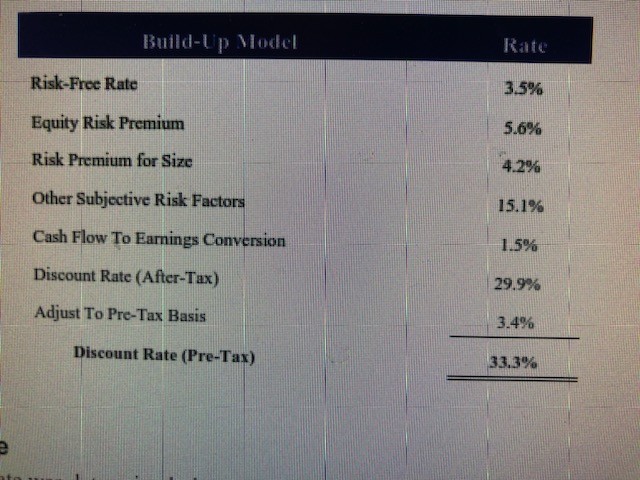

However, RSI only valued Cantu's business at $1.27 million because of a 33.3% risk assessment discount included in the overall discounted future earnings report.

Also included in the discount rate was the category "other subjective risk factors," which accounted for nearly half of the overall discount, RSI's report shows.

Even so, Cantu and his attorney have since filed a lawsuit in Bexar County Probate Court No. 1 seeking testimony from those involved in discussions between the Alamo Trust and RSI. The bar owner said he wants to know how "projected lost revenue" was defined and whether the Alamo Trust coerced RSI to skew the valuation data.

As of press time Tuesday morning, the city has yet to file documents to condemn Moses Rose's. However, city council voted in January to move ahead with eminent domain proceedings against the bar, meaning that process could begin at any time.

Follow us: Google News | NewsBreak | Instagram | Facebook | Twitter