The common theme in his latest vetoes, 21 of which were announced Friday: The bills can wait until after lawmakers figure out property taxes.

"At this time, the legislature must concentrate on delivering property tax cuts to Texans," Abbott said in multiple veto proclamations Friday.

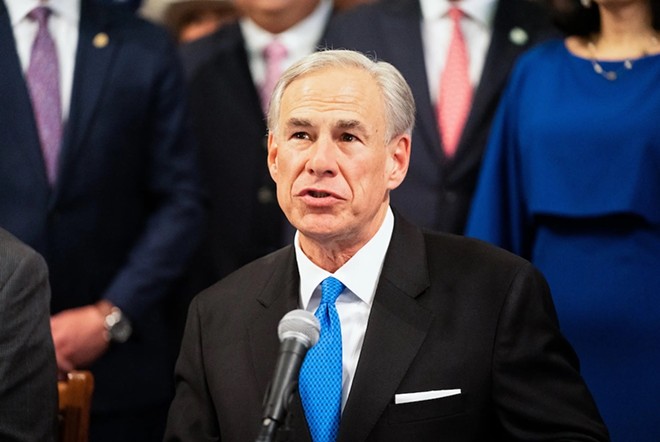

On Wednesday during a bill-signing ceremony at the Capitol, Abbott raised the possibility of vetoing a significant number of the hundreds of bills that he hasn’t yet signed. With lawmakers still deadlocked on property taxes, Abbott said he “can’t ensure that any bill that has not yet been signed is going to be signed.”

The governor has two more days to veto legislation before those bills from the regular session become law, with or without his signature. When the House and Senate failed to reach a compromise on property tax relief during the regular session, Abbott immediately called lawmakers into a special session. The House and Senate have yet to find a mutual agreement on the issue as they differ on how exactly to make property tax cuts.

Lawmakers in both parties lamented Abbott's vetoes Friday.

State Sen. Phil King, R-Weatherford, said in a statement that he was “extremely disappointed” that Abbott vetoed King’s Senate Bill 267. The bill would have helped more Texas police departments receive accreditation, a proposal that came out of the botched law enforcement response to the 2022 Uvalde school shooting.

State Sen. Sarah Eckhardt, D-Austin, also went public with outrage over Abbott’s veto of her Senate Bill 361. The legislation would have allowed teachers to serve on appraisal review boards.

“This was NOT Vetoed on POLICY,” she tweeted. “It’s shameful this & many other good pieces of legislation are falling victim to the ongoing political disagreement between the Gov & [lieutenant governor]!”

In the last four days, the governor has axed four bills authored or sponsored by state Sen. Paul Bettencourt, R-Houston, the Senate’s top expert on property taxes. In explaining the reason for the recent string of vetoes, Abbott said other issues are off the table until the House and Senate come to an agreement.

“This bill can be reconsidered at a future special session only after property tax relief is passed,” Abbott wrote in his Thursday veto proclamation for three bills, including Senate Bill 1998, an uncontroversial piece of legislation that would have made changes to tax rate calculation forms for property taxes.

Abbott included the same message — this bill can wait — in all the other vetoes he has issued since Tuesday.

Other vetoed bills ranged in focus from the sale of charitable raffle tickets to where tenants can find contractors to make repairs.

The rash of vetoes further provoked Patrick, who has staunchly defended the Senate’s version of property tax relief.

“This is targeted vetoing of bills that have nothing to do with the issue at hand except Paul Bettencourt is the author of those bills,” Patrick said during a Dallas news conference on Thursday. “It’s not a very good image to veto bills for no reason other than he didn’t get the property tax bill he wants.”

Patrick’s public barbs directed toward Abbott were unusual, given the two Republicans have historically worked out their differences behind the scenes. Abbott initially supported the House’s version of property tax relief but he has since asked the two chambers to strike an agreement that can reach his desk. Neither Abbott nor Patrick’s offices immediately returned requests for comment on Thursday evening.

The House and Senate have been at odds over the best way to deliver property tax relief since the special session began on May 29, the same day the regular session ended.

Abbott called for lawmakers to exclusively focus on a method known as compression, or sending state funds to school districts to help lower their property tax rates. The House quickly obliged Abbott and left town, but the Senate has remained in session while insisting on also increasing the homestead exemption, which is the chunk of a home’s appraised value that is exempt from property taxes.

By Friday afternoon, Abbott had vetoed a total of 31 bills. That is more bills than he vetoed after the last regular session (21), but still fewer than his 58 vetoes in 2019, 51 in 2017 and 44 in 2015.

Former Gov. Rick Perry holds the record for most vetoes, issuing 83 in 2001, according to the Legislative Reference Library.

This article originally appeared in the Texas Tribune.

The Texas Tribune is a member-supported, nonpartisan newsroom informing and engaging Texans on state politics and policy. Learn more at texastribune.org.

Subscribe to SA Current newsletters.Follow us: Apple News | Google News | NewsBreak | Reddit | Instagram | Facebook | Twitter| Or sign up for our RSS Feed